Source: Geoff Williams.

With a raft of home improvement websites that specialize in matching homeowners to contractors, and social media sites making it easy to receive referrals from friends and family, finding a reliable contractor is a straightforward process.

But once you find a potential contractor, you must ensure he or she is the right fit for your home improvement project. That’s why many experts advise making a few key inquiries to learn more about a prospective contractor and assess accountability before hiring one. Before you select a contractor, ask these questions to set realistic expectations, avoid hitting major snags and ensure you get what you want.

1. Do you have references? “It is always a good thing to ask for references. You don’t necessarily need to call them, but you should always request them,” says Nathan Outlaw, owner of Onvico, a general contracting company in Thomasville, Georgia. “If a…

View original post 1,049 more words

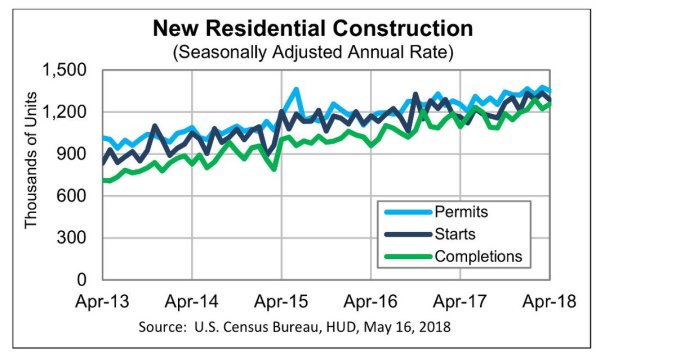

From Census:

From Census: